Ask any finance team what cash reporting is and they’ll likely tell you it’s the one of the most time-consuming tasks on their calendar. But it’s also the best way to understand how money moves in and out of a business.

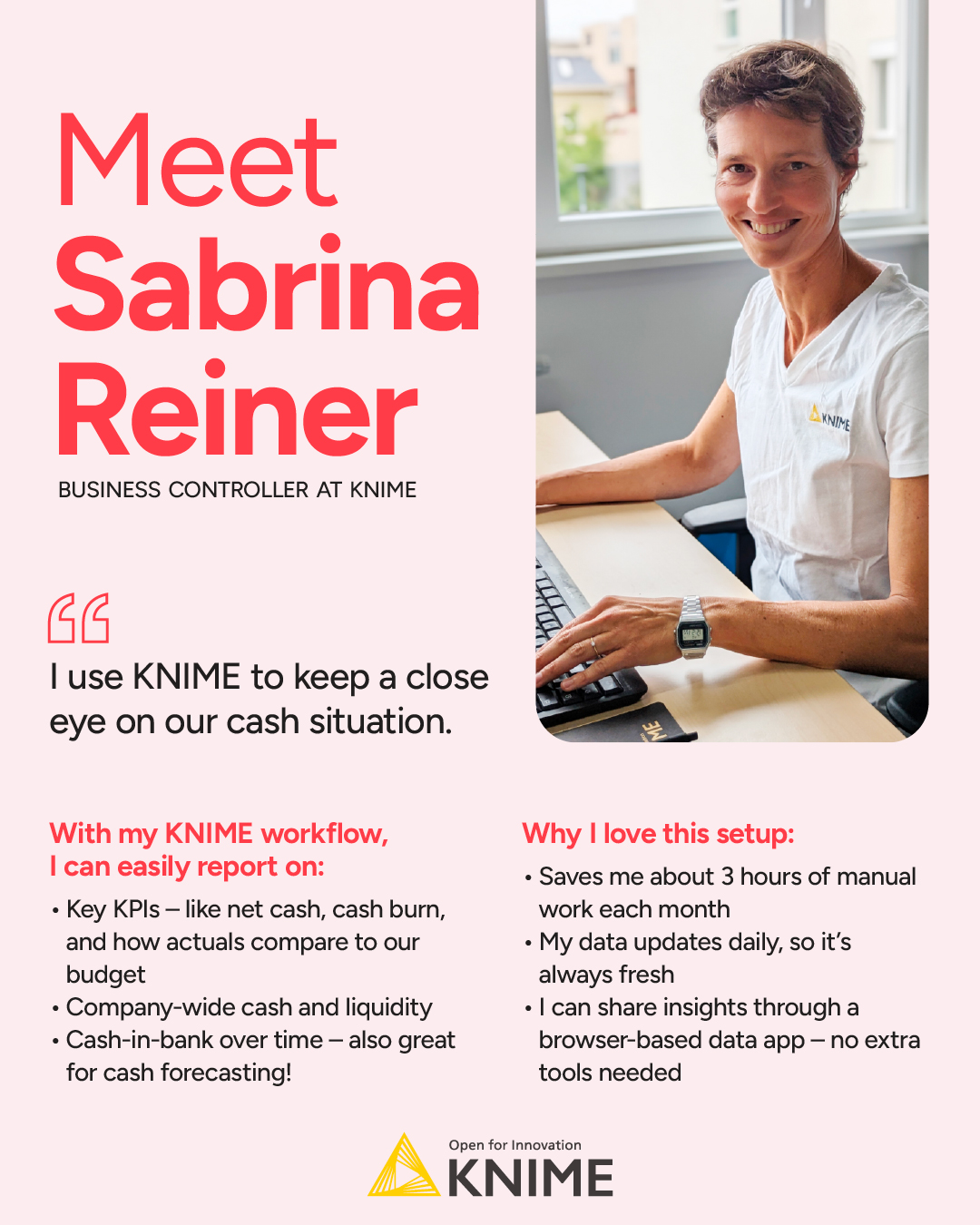

I’m Sabrina Reiner, Business Controller in Internal Operations at KNIME. I analyze KNIME’s financial data, tracking transactions from multiple bank accounts in different currencies, consolidating expenses charged to business credit cards, collecting data from employees’ salary reports, and more.

It’s not something I like to make mistakes in. But it’s complex. So I used to double- and triple-check everything I did to make sure errors hadn’t crept into my work — mistyping a number, skipping a field in my spreadsheet, forgetting to format a column the right way. But the biggest “mistake” I was making was not automating as many processes as I could.

That had to change.

Because manual processes just don’t work for complexity

From ensuring there’s enough liquidity to recruiting new employees, meeting upcoming obligations, and supporting strategic decision-making, cash reporting feeds directly into higher-level functions like financial planning and risk management.

The complexity of cash reporting increases with every additional bank account, business entity, and currency that’s involved. Gathering data from multiple banks, reconciling balances, performing currency conversions, and delivering consistent, daily insights quickly becomes a manual process.

But when your data resides in different systems — some in ERP systems, others in bank portals, spreadsheets, or internal tools, the end result is fragmented, error-prone reporting and doesn’t scale.

Address complexity with data science + AI = automation

Working at KNIME, it was an obvious next step for me to look at KNIME Analytics Platform for a solution.

KNIME isn’t a traditional financial system, but that’s exactly what makes it powerful. As a data science and AI platform, it’s designed to handle complexity and offers the flexibility I needed to build a custom solution tailored to my specific data landscape and reporting needs.

Instead of relying solely on the ERP system — or being limited by it — finance teams can use KNIME to bring together disparate data sources, automate recurring processes, and provide access to up-to-date cash reporting without adding IT or infrastructure overhead.

5 ways KNIME transformed our cash reporting process

To enhance the transparency, quality, and efficiency in financial management, I’ve developed a comprehensive reporting solution that brings together all key aspects of our multi-entity, multi-currency operations.

I use this workflow for:

- Reporting financial KPIs to Management (Net Cash, Cash Generation/ Cash Burn, Actuals vs Budget)

- Cash/Liquidity Management within the company

- Reporting Cash in Bank for past time frames and also as a base for Cash Forecasting

The benefits of my KNIME solution:

- The workflow saves me roughly three hours of manual work per month

- The data is always up to date and available on a daily basis

- I can share the analysis with a browser-based data app

Here’s a top-level overview of the tasks this workflow carries out (and I no longer need to spend time on).

#1. Automate data integration across sources

One of the core features of my workflow is the integration of multiple data sources into a single, unified reporting layer. KNIME acts as a central hub, enabling me to easily pull in data from various formats and sources- offering a holistic view of our financial status across the organization.

And if I need to update or add a new data source, I can, without having to rebuild the entire reporting process.

#2. Automate currency conversion

One of the pain points in traditional cash reporting is dealing with foreign currency accounts. Exchange rates fluctuate daily, and manually applying conversion rates across dozens of accounts opens the door to errors.

In my KNIME workflow, I can automate currency conversion based on real-time exchange rates to standardize values. This ensures accurate and consistent reporting across our international bank accounts in our reporting currency.

This eliminates manual conversion errors and saves valuable time.

#3. Daily overview of our net cash positions

One of the most immediate benefits I’ve seen with KNIME is the ability to get a daily overview of our net cash position across all our bank accounts. Previously, this required calculating multiple bank statements manually, and consolidating the information into a central file.

KNIME automates this process by using all integrated data, pulling them together and calculating all figures in our reporting currency.

I now have a daily aggregated view of all bank account balances — both at the individual account level and consolidated for the entire company. By adding the budget numbers, I can also get an actual versus budget comparison.

This timely snapshot allows for more informed decision-making and has improved our liquidity planning.

#4. Monthly overview of Cash-In and Cash-Out movements

To complement visibility, I also generate monthly totals of cash-in and cash-out movements for each bank account, each entity, and the company as a whole.

These insights form the foundation for calculating monthly cash burn and cash generation, and how our actuals compare to budget and/or forecast, which gives me a clear picture of how healthy we are financially across the business.

This level of granularity enables me to monitor liquidity trends, optimize treasury strategies, and proactively address deviations from expected cash flow which supports deeper financial forecasting and analysis.

Drilling down further, the workflow gives me a detailed breakdown of every transaction. This enables me to categorize entries into our revenue and cost types and conduct in-depth comparisons between actuals and budgeted figures. This improves the accuracy of our budget and strengthens our control over spending.

#5. Company-wide view of net cash positions via KNIME Hub:

We operate across several legal entities, each with its own set of bank accounts. We needed an aggregated, company-wide snapshot of the net cash positions.

With KNIME, I was able to generate a daily summary of cash positions for each entity, as well as a combined view for the entire organization.

This kind of visibility used to take days to compile manually; Now it’s available on-demand through a browser-based data app, and always up to date. I can share the link to the data app with colleagues or my manager so they can check in ad hoc to see our cash positions.

Below you can see an example of the data app. Note that the data shown here is mock data.

I can also schedule the workflow to automatically write all the relevant data to our shared finance folder, using KNIME Hub. This ensures that everyone on the team can access up-to-date information, even if the responsible colleague is sick or on vacation — fostering continuity, transparency, and shared responsibility.

Beyond cash reporting: Supporting broader finance goals

KNIME has proven to be more than just a tool for cash reporting. With its flexibility and automation capabilities, we’ve been able to extend its use to support reporting of financial KPIs to management, such as Net Cash, Cash Generation, and the comparison Actuals versus Budget.

The real-time and historical data enabled by KNIME allows for more effective cash and liquidity management. With a clear view of cash trends, we can make better decisions about investments, funding needs, and cost management. And because we can pull historical data as well, KNIME provides a reliable base for cash forecasting, helping us anticipate future cash positions and plan accordingly.

KNIME makes learning feel natural — even if you're just starting out

Perhaps best of all — it’s genuinely fun to build these workflows, especially with K-AI.

K-AI is KNIME’s AI Assistant, which makes automation even smarter and more intuitive. A colleague of mine, who primarily worked in spreadsheets, saw how easy it was for me to start building workflows, and caught the bug!

She developed a workflow for our regular cost location reporting, where we get the same benefits: It can be scheduled to run at any point in time, shared easily within the company via the data app, and it’s easy to adjust it if needed.

It’s easy to upskill because you quickly see value. If you want to try it out yourself, download KNIME.