Spreadsheet-based solutions for reconciliation are a minefield of non-intentional but inevitable mistakes. So, to no surprise, human error is an organization's biggest data reconciliation pain point - more serious than lack of operational data, operational risk, compliance, and regulatory risk.

But an expensive, custom-built IT solution is not the only way out of error-prone financial reconciliation. A more sophisticated data analytics tool can significantly diminish the risk of error.

KNIME removes the risk of errors by letting you easily create reusable, secure processes. Because the steps within the processes are pre-defined, your chances of messing up (or worse: someone else messing up), are eliminated. And, there’s nothing going on under the hood that you aren’t already doing in Excel.

Eliminate human error by setting up processes to remove rework

Because spreadsheets are managed manually, you’re tasked with entering data by hand and then scanning for inconsistencies. The result: unintentional, but potentially critical human error. On top of that, you’re wasting several hours each day. Having a repeatable process would avoid these errors and give you your time back.

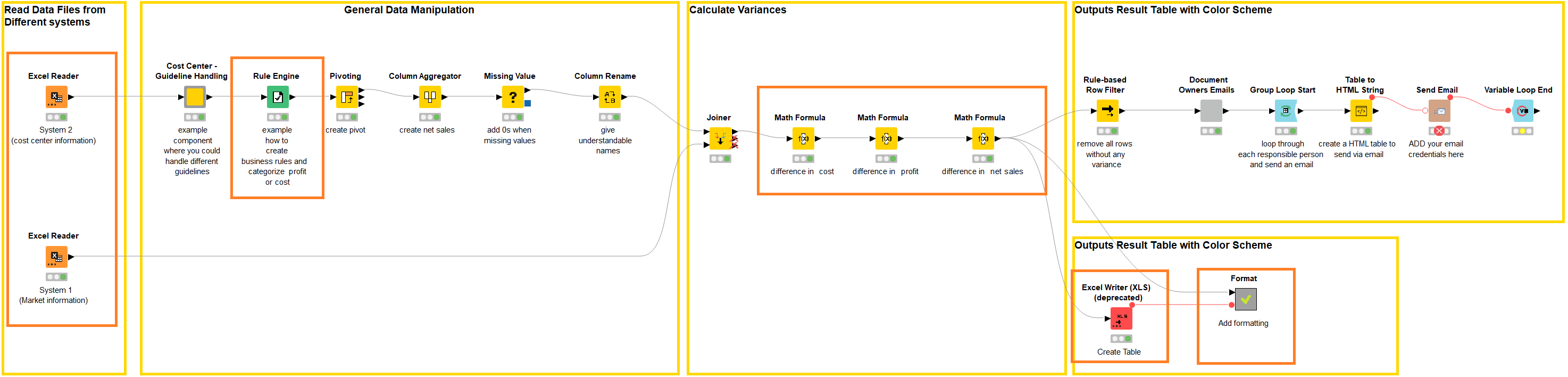

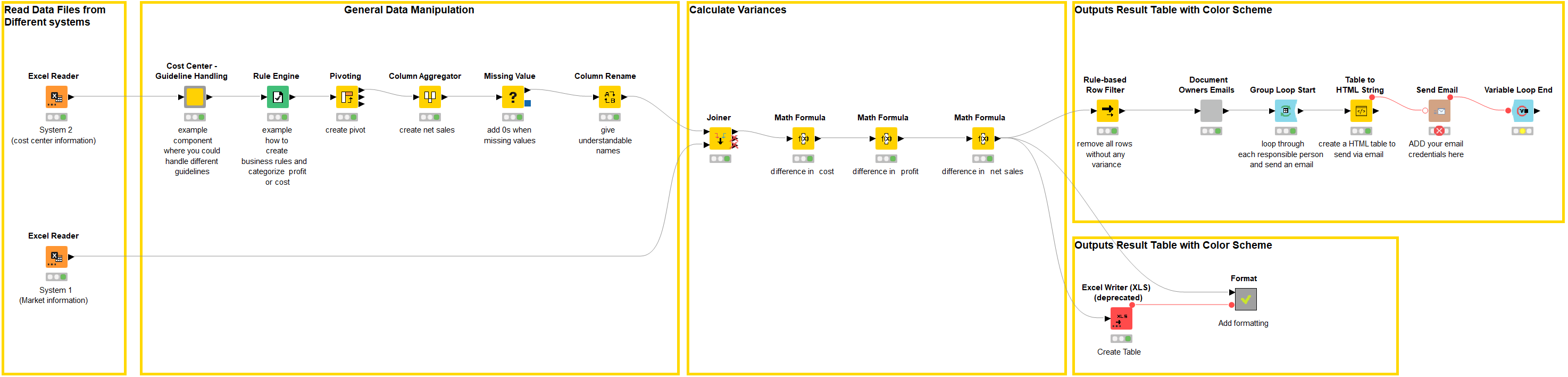

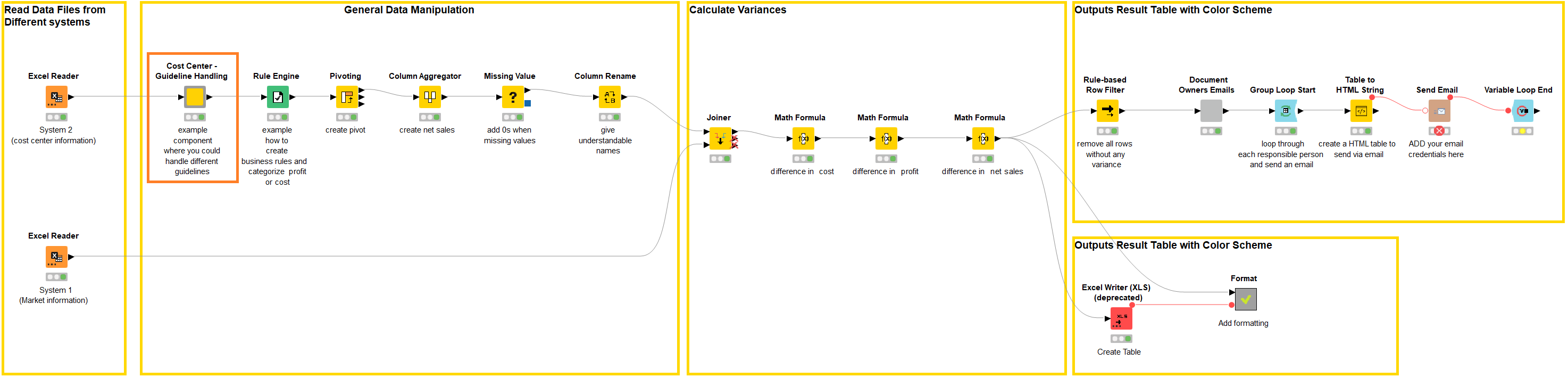

KNIME enables you to build a process once and reuse it over and over again. Pre-define all your steps to avoid reinventing the wheel each time. Then simply upload your data and execute the workflow. The Rule Engine takes care of the comparisons, the Math Formula calculates the differences, the Excel Writer creates a new spreadsheet, and the Format component highlights errors.

Free up your time by running work automatically

Same story, different day. Gather data sources, get them into the right format, normalize and enrich them, check for errors, and send them to the relevant individuals. The next morning your inbox is full of attached spreadsheets with comments so you can complete the reconciliation. But the next one is waiting for you already. Being able to automate these tasks would save you hours each day.

KNIME enables you to automate all of these steps on whatever basis you need: hourly, daily, monthly. And there’s no additional workflow needed besides the one you just built. Just a few clicks to set the cadence. Get reconciliations done faster, receive feedback earlier, and spend your time analyzing the numbers instead of scanning for errors.

Prevent template tampering to ensure security

There’s nothing worse than opening a spreadsheet only to find it’s been tampered with. Instead of finalizing the reconciliation, you spend your day correcting errors, verifying data entry, and finding what formulas were edited. This also contributes to processes and best practices being ignored as well as reporting inconsistencies. From a compliance standpoint, it screams unsecure.

KNIME enables templates to be created as visual workflows where each step automatically documents what’s happening, and records any changes. Parts of a workflow (components) can be locked to ensure no changes are made. This guarantees compliance and ensures that reconciliations all follow the same process.

KNIME does the heavy lifting and you get your life back

Spreadsheets are never going to be entirely removed from financial reconciliation processes. But you don’t have to continue wrangling them to get results. Nor do you have to live in the constant fear that you might have missed something critical.

Building repeatable processes and automating them will ensure that you spend less time going cross-eyed in spreadsheets and more time generating insights to drive the organization forward.

Check out more examples of how KNIME is used in the Financial Services & Banking Industries.