Sales Apportionment with KNIME

Utilize sales apportionment analytics to allocate revenue across states, even when billing data is incomplete. KNIME helps you calculate subscription-based sales by location, apportion unknown sales, and apply state-level tax rates—enabling accurate tax estimates, audit-ready reports, and clear visual summaries.

KNIME Workflow Example for Sales Apportionment

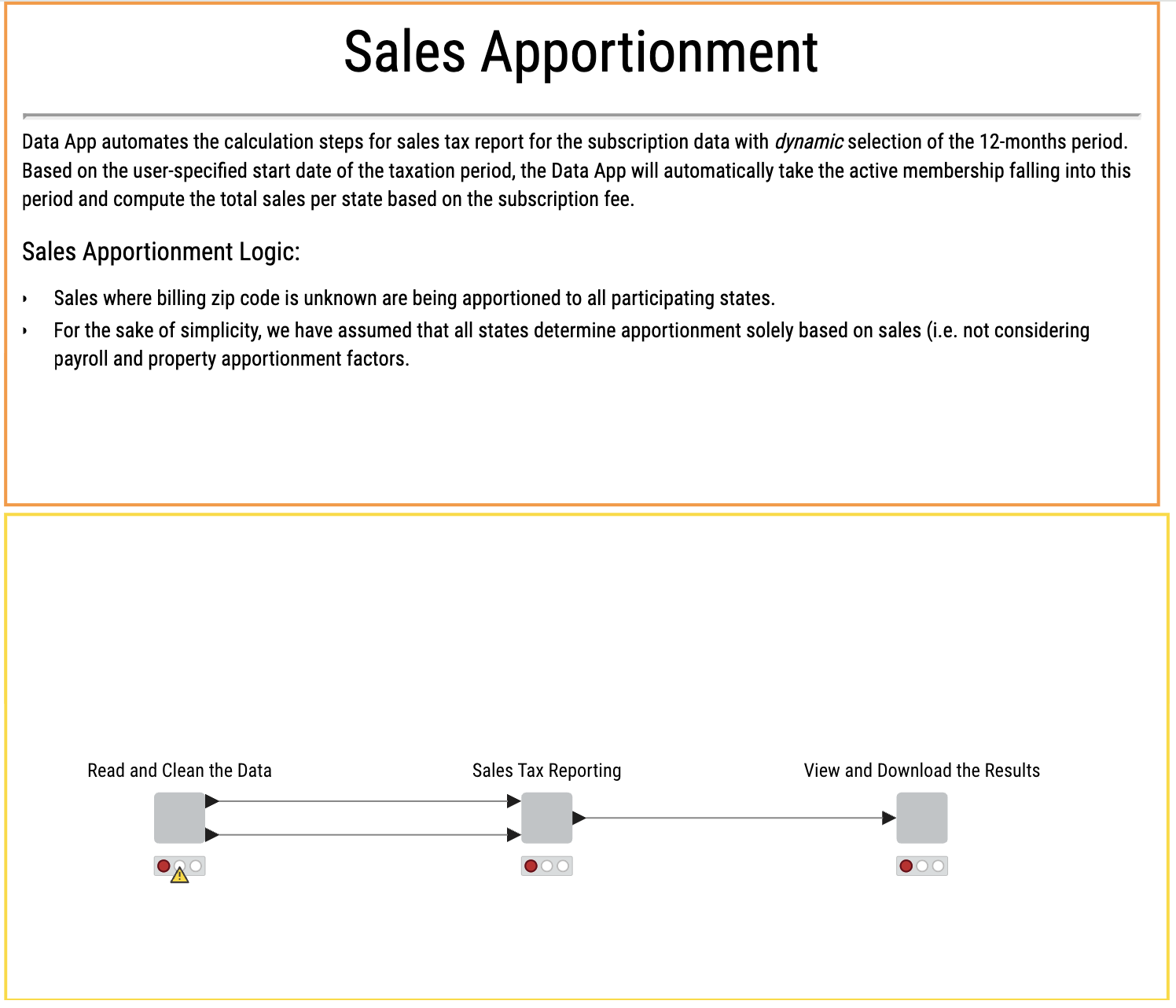

This Sales Apportionment example workflow provides a structured, interactive way to calculate subscription-based sales by state—even when billing data is incomplete. It includes:

- Upload subscription or membership records, along with reference files such as zip-to-state mappings and tax rate tables. These inputs form the foundation for calculating state-level sales and tax liabilities.

- Select a reporting start date using a built-in widget. The workflow dynamically filters the data to include only subscriptions active within the trailing 12-month period. Sales amounts are prorated based on active days in the window.

- Identify records missing billing location data and apportion those sales across states using equal or weighted logic. Then, match total state sales to a tax rate table to compute sales tax due per jurisdiction.

- The entire process is packaged in a Data App, giving users a guided, code-free interface for uploading data, setting reporting periods, and downloading results—ideal for finance or operations teams managing tax reporting.

Why use KNIME for Sales Apportionment

What is Sales Apportionment?

Sales apportionment is the process of allocating a business’s revenue over different tax jurisdictions, especially when the exact location of some transactions is unknown. It ensures you estimate tax liability correctly, comply with jurisdictional tax laws, and produce consistent reports.

Why does it matter?

Tax authorities often require state-by-state revenue breakdowns to accurately calculate sales or subscription tax. But when customer location data is missing or incomplete, estimates can become inaccurate—creating compliance risks and potential audit issues. Manual apportionment across states is not only time-consuming but also error-prone, especially when reporting over rolling periods like the past 12 months. Automated, reproducible workflows provide consistency, reduce audit exposure, and make it easier to respond to regulatory questions with confidence.

Typical challenges

- Incomplete or missing billing addresses and zip codes make it hard to assign sales to the correct state

- Subscription periods often span multiple jurisdictions or shift over time, complicating calculations

- Reporting based on rolling 12-month periods requires dynamic filtering that manual tools struggle to handle

- Tax rates vary by state and change over time, requiring constant updates to stay accurate

- Manual methods don’t scale well as customer volumes grow, making reporting and compliance harder to maintain

Benefits of using KNIME

- Filters subscription records dynamically based on a user-defined 12-month reporting window

- Distributes unknown-location sales across states using customizable apportionment logic

- Integrates with external datasets like zip-to-state mappings and tax rate tables for accurate calculations

- KNIME workflows ensure the process is repeatable, auditable, and scalable across reporting cycles

- Enables the use of Data Apps where users can select reporting periods, upload input files, and download results interactively

How to use KNIME for Sales Apportionment

Data Input and Preparation

Sales and Tax Calculation

Each subscription’s fee is prorated based on its active duration within the selected reporting period, and total sales are calculated accordingly. For records with missing location data, the workflow flags them and distributes the associated sales across all states—either equally or using a weighted method, if supporting data is available. These apportioned sales are then matched with state-specific tax rates to calculate the total sales tax liability per jurisdiction, ensuring accurate and compliant reporting.

Interactive Reporting and Visualization

The workflow is a Data App with an interactive interface designed for non-technical users. A date selection widget lets users define the reporting start point, automatically filtering the data to cover the trailing 12-month period. This dynamic setup allows for recalculating results across different timeframes without modifying the workflow. Users can upload their data, trigger updates, and download final outputs directly within the app. Results are presented in both tabular and visual formats—including state-level breakdowns, unknowns, and pie or bar charts—with filtering options and Excel export functionality to support reporting, review, and audit readiness.

How to Get Started

Additional Resources

Collection page: KNIME For Finance

A set of ready-to-use solutions designed to speed up analytics transformations in finance departments.

KNIME, Automation, and AI

Ready-to-use solutions to speed up analytics transformation within finance departments.

FAQ

You'll need your subscription or membership data (with fields like start date, zip code, and fee), a zip-to-state mapping file, and a table of state tax rates. These can be uploaded directly through the Data App interface.

Yes. The workflow apportions unknown sales equally among states by default. You can change that, e.g., weight by known sales, population, or other applicable factors by modifying the join/apportionment component.

The workflow calculates duration within the reporting period pro rata. You can adjust the logic if your business defines billing differently (e.g, start vs. renewal, cancellation dates, etc.).

Yes. Once configured, you can schedule the workflow to run at regular intervals (monthly, quarterly) using one of KNIME’s paid plans with scheduled jobs.