Dunning Management Process with KNIME

Use Dunning Management analytics to stay ahead of overdue invoices and ensure consistent customer follow-up. KNIME helps you consolidate payment data, flag late accounts, and track communication history—making it easier to prioritize outreach, reduce days-sales-outstanding, and improve cash flow visibility.

KNIME Workflow Example for Dunning Management

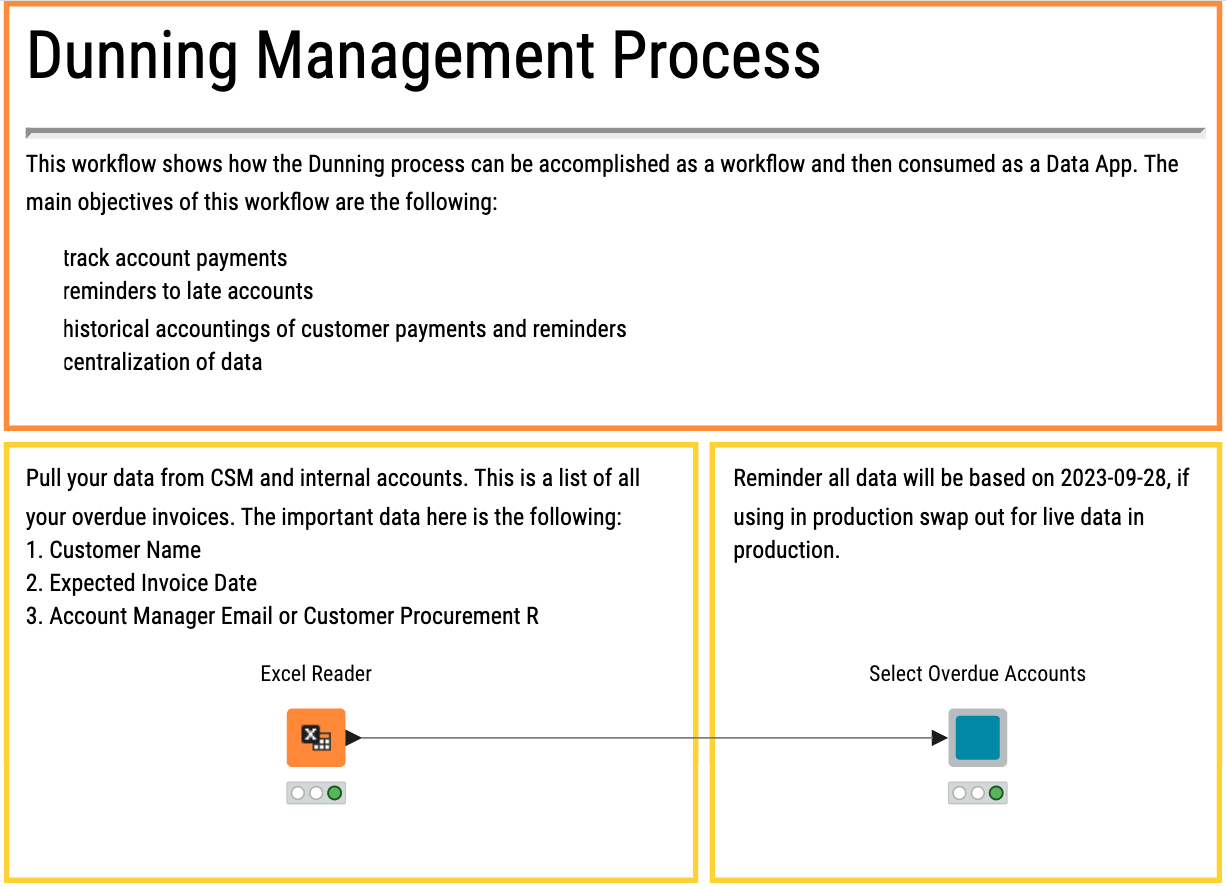

This Dunning Management example workflow provides a guided way to monitor overdue invoices and track customer communication using a visual, interactive interface. It includes:

- Import account and invoice data along with a comments log from Excel or other systems. Merge this information to build a complete view of each overdue account, including due dates, payment status, and past follow-ups.

- Enable account selection through a table view and a refresh button. When an account is selected, detailed payment and contact history are displayed. Accounts are automatically color-coded—green if contacted within 7 days, red if a follow-up is needed.

- Allow finance or renewal teams to log new comments or update past notes directly in the app. Once updated, the account status changes to reflect recent activity. The entire workflow is presented as a Data App, offering an intuitive, code-free interface with editable fields and visual cues to support consistent and auditable follow-up.

Why use KNIME for Dunning Management

What is Dunning Management?

Dunning management refers to the process of following up with customers to collect payments on overdue invoices. The process includes tracking outstanding balances, sending reminders, logging communications, and escalating action as needed. It’s a core function of accounts receivable and finance operations.

Why does it matter?

Late payments impact cash flow and working capital, making it harder to manage day-to-day operations. Without a clear system to track reminders and responses, follow-ups can be delayed, duplicated, or missed entirely—frustrating both customers and finance teams. Manual tracking in spreadsheets doesn't scale and often leads to errors. A structured view of overdue accounts and their communication history supports better forecasting, prioritization, and faster collections.

Typical challenges

- Tracking overdue invoices across multiple systems is time-consuming and error-prone

- Communication history with customers is often incomplete or inconsistent

- It’s difficult to prioritize follow-ups based on payment risk or urgency

- Manual processes don’t scale well and make reporting and oversight harder

- Teams lack real-time visibility into account status, reminders, and outcomes

Benefits of using KNIME

- Connects to invoicing, CRM, and payment systems to unify account and payment data

- Flags overdue accounts and categorizes them by aging buckets using rule-based logic

- Tracks reminder history and customer interactions in a structured, searchable format

- KNIME workflows make the dunning process transparent, auditable, and easy to adjust

- Enables the usage of Data Apps for finance teams to review status, add notes, and prioritize follow-ups

How to use KNIME for Dunning Management

Data Access and Integration

Import account and invoice data from Excel or connected systems. The workflow reads a dedicated table that tracks all customer notes and communication history. This data is merged with invoice records to create a complete view of overdue accounts, including due dates, payment status, and contact history.

Interactive Account Review

Users select a specific account in the table view. A refresh button retrieves detailed information for that account, including past communications. Color-coded status is assigned automatically: green if the customer was contacted in the last 7 days, red if follow-up is due. This helps prioritize outreach visually.

Comment Logging and visualization

The workflow displays current and historical comments for each account. Renewal or finance team members can add new notes or edit existing ones directly within the app. After updating and refreshing, the account status changes from red to green to reflect recent contact. Visualization is done by building a DataApp. The interface is tailored for non-technical users. It provides editable fields, color-coded tables, and guided interaction for tracking overdue accounts and maintaining communication logs in a consistent, auditable format.

How to Get Started

Additional Resources

Collection page: KNIME For Finance

A set of ready-to-use solutions designed to speed up analytics transformations in finance departments.

KNIME, Automation, and AI

Ready-to-use solutions to speed up analytics transformation within finance departments.

FAQ

You’ll need invoice data (amount due, due date), customer identifiers, payment status, renewal dates if relevant, previous reminders/communications, and account contact info. The workflow uses dummy data by default, so you’ll need to replace that with your own.

Yes, the workflow is designed so you could extend it with send email functionality, and using one of KNIME’s paid plans, you can schedule the workflow for sending emails.

It uses rules to color-code accounts: for example, “green” if contacted in the past 7 days; “red” otherwise. This helps account managers prioritize.

Yes. KNIME workflows are fully customizable. You can adjust rules for overdue classification, extend the workflow with email or alert functionality, or connect it to different data sources such as ERP systems, CRMs, or cloud databases.