How pbb Optimizes Data Processing with KNIME

Deutsche Pfandbriefbank (pbb) is a mid-sized German bank, specializing in real estate and public sector financing.

Summary:

The challenge: New regulatory requirements highlighted the need for increased automation and efficiency in data management. pbb needed to modernize its data processes but faced challenges due to:

- Legacy IT systems and manual processes that hampered data governance, reporting and regulatory compliance

- Lack of centralized oversight for end-user computing tools and inconsistent development standards

The solution:

- Introduced KNIME to automate data quality reporting and checks

- Established a KNIME Data Analytics Hub team for oversight, development and consulting

- Integrated KNIME with SAP, Jira and Qlik Sense to build a fully automated data pipeline

The results:

- 52 person-days saved annually to date having migrated critical workflows from manual to fully automated

- Faster ad-hoc reporting and ESG risk modeling under tight timelines and complexity

- Ability to scale data quality, AI, and ESG initiatives across the bank with KNIME Server

- Regulatory-compliant applications development and documentation processes

Challenge: Legacy challenges in a traditional banking environment

Deutsche Pfandbriefbank (pbb) works in a highly regulated banking environment and handles high-value investments—typically between €50 to €250 million per investment—which makes precision in data governance and regulatory compliance essential.

pbb’s IT infrastructure has grown increasingly complex over time, with disparate processes and systems.

Data processing at pbb was reliant on many manual solutions and end-user-computing (EUC) tools – for example spreadsheets, access databases, etc. With a lack of transparency in data processing, errors in seemingly harmless EUC applications can carry through and result in inaccurate information.

At pbb, EUC know-how was limited to just a few colleagues, so development and maintenance work often had to be carried out by external partners. This was a tedious and cumbersome process that was difficult to maintain.

pbb initiated efforts to automate its manual data quality reporting processes in order to gain flexibility, speed, compliance, a reduction in complexity, and more transparency.

Nicola Petkov’s team conducted a thorough software selection process and chose KNIME for its low-code capabilities and robust functionality. Following a successful proof of concept in 2020, the bank recognized KNIME’s potential to beyond its original intended use for data quality.

“We saw very, very quickly that we can use KNIME not only for data quality, but for many other use cases” – Nikola Petkov, Project Lead, Dept. of Processes & Data Management, Deutsche Pfandbriefbank

“We are establishing KNIME as a flexible, dynamic, data processing platform that guarantees the highest standards of quality assurance and efficiency and enables the optimization of data processing procedures.” Nikola Petkov, Project Lead, Dept. of Processes & Data Management, Deutsche Pfandbriefbank.

Solution: Implement a “KNIME Data Analytics Hub” to reduce regulatory risk

Starting with KNIME Analytics Platform

The team around Nikola Petkov officially launched a KNIME Data Analytics Hub as a centralized unit to oversee all KNIME development. Today, this hub provides consulting, development resources, and ensures that every KNIME-based application meets the bank’s strict IT governance standards.

"Everything that we produce with KNIME is a real application and not an EUC tool. This shift significantly reduced the regulatory risks associated with shadow IT.” – Nikola Petkov, Project Lead, Dept. of Processes & Data Management, Deutsche Pfandbriefbank

Within just 18 months of the official launch, four use cases and 50+ workflows were live. Here are the four use cases pbb put in place:

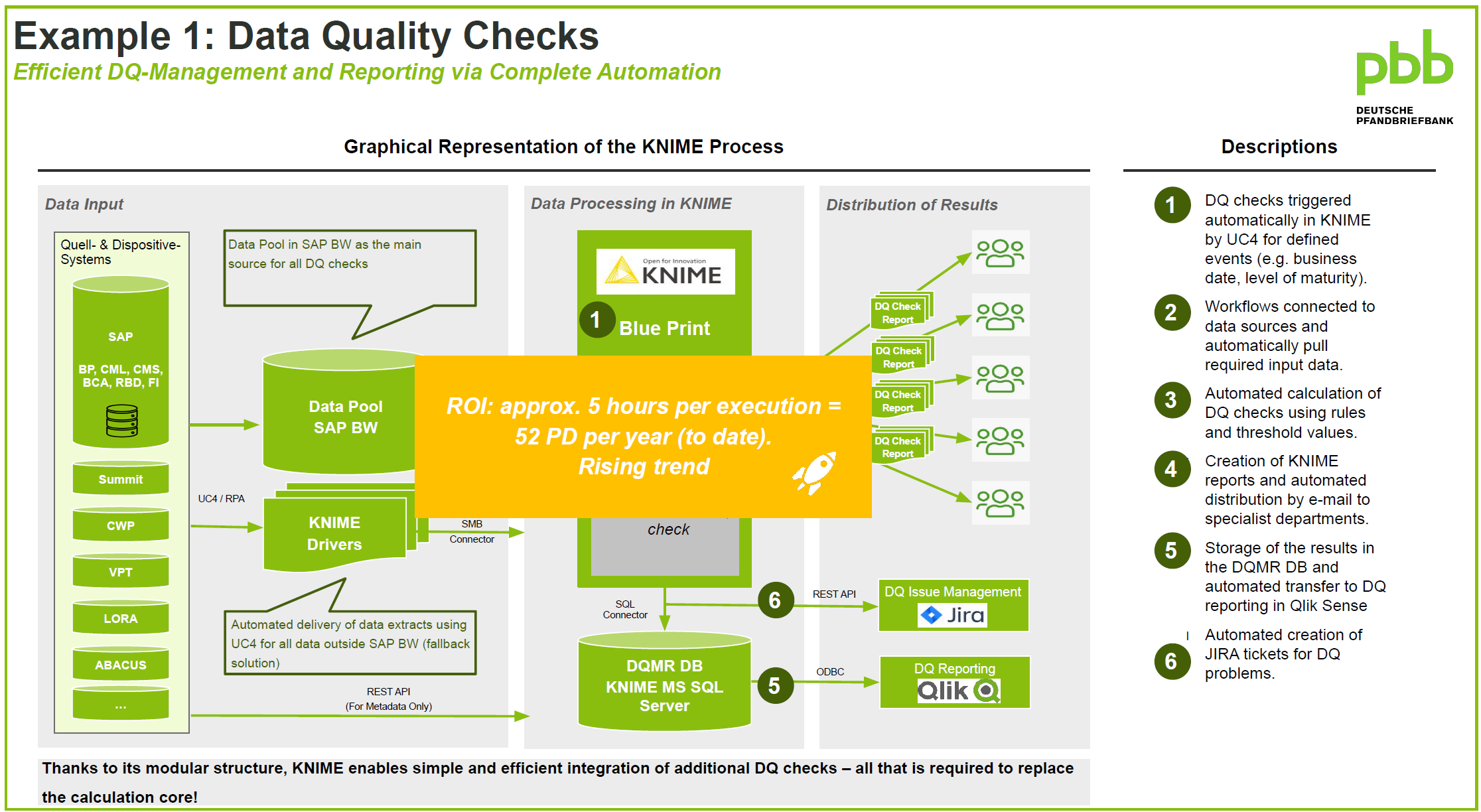

1. Data quality automation saves 52 person-days annually

KNIME was first deployed to address pbb’s pressing need for automated data quality reporting. KNIME supports integration with UC4, an automation platform that pbb uses to see which jobs are started by which applications. The bank implemented end-to-end KNIME workflows that:

- Fetch data automatically via UC4 scheduling

- Separate valid from invalid datasets

- Generate and send reports automatically to business departments

- Push data to Qlik Sense for reporting and open tickets in Jira for issue tracking

With this system in place, the bank saves approximately 52 person-days annually. "This is a very good result, and the trend is rising," said Petkov. “The time saved on tedious data preparation means that our business analysts have more time for important tasks and can focus on more valuable business analysis. With KNIME we’ve achieved more efficient data processing and greater employee satisfaction.”

Explore the full slide deck, Optimizing Data Processing with KNIME at pbb, by Nikola Petkov, Deutsche Pfandbriefbank AG

2. Regulatory compliance ensured by balance sheet generation within 24 hours

Regulators require that banks be able to generate a balance sheet within 24 hours in emergency situations. Given the rigid legacy infrastructure, this would have been nearly impossible without KNIME's flexibility. Now pbb can remain compliant with regulations and generate a balance sheet within the required time-frame thanks to KNIME.

3. AI-supported deal decisions

Petrov’s team has developed different AI models using KNIME. One is used to automatically identify data quality anomalies, while the second is a predictive model that assists in deal decision-making.

While this model does not replace the deal committee, the model supports decisions by providing outcome probabilities. This use of KNIME for AI adds analytical rigor to financial operations.

4. Making ESG risk modeling a repeatable, auditable process

ESG risk modeling is an area fraught with complexity and regulatory scrutiny. Prior to KNIME, pbb lacked a cohesive, automated approach to assess environmental, social, and governance risks.

With KNIME, the bank built a model that calculates ESG risk metrics and integrates them into existing reporting pipelines. The model connects with internal data sources via secure, automated channels and writes back results to enterprise platforms.

This use case showcases KNIME’s power in helping traditional financial institutions handle emerging compliance challenges. While Petrov didn’t quantify time savings here, the implication was clear: this system turned what was once a major challenge into a repeatable, auditable process.

Results: Measurable efficiency gains

Through pbb’s partnership with KNIME, they have achieved:

- Time savings: Automated workflows have saved the bank over 52 person-days annually in data quality checks, with additional savings anticipated as further processes are automated.

- Improved data governance: Integrating KNIME into the IT infrastructure ensures workflows meet high standards for quality assurance and regulatory compliance. Nikola noted, “Everything we produce with KNIME is treated as a real application, not an end-user computing tool.”

- Enhanced flexibility: KNIME’s easy integration with systems like SAP Business Warehouse, UC4, Qlik Sense, and Jira has streamlined operations and optimized reporting processes

KNIME: A platform for the future

Looking forward, pbb has an ambitious backlog of KNIME-powered initiatives, from service level agreements and data lineage tracking to further process automation.

Petkov summed up their vision clearly:

“We want to establish KNIME as a flexible, dynamic, data processing platform that guarantees the highest standards of quality assurance and efficiency and enables the optimization of data processing procedures.”

Learn more about KNIME Business Hub and how it can help your organization or schedule a demo with our customer care team to see how it works in practice.